Loan Sharks Alternative Cash Resources

Fast Loan Sharks Loans On-Line options can be found here on line today.

Although Payday loans could be expensive with quite high APR’s, if used as short-term loans, they are able to be very helpful for life’s small (or large!) unforeseen emergencies and are much more preferred than a loan shark.

With the new Financial Conduct Authority regulations that now limit the payday lender’s charges, there are less companies supplying payday loans and so less option for folks desiring a small quick cash loan.

Don’t Use Loan Sharks!

With alternatives for applying for a small cash loan getting much less, where are people going to turn to?

It seems that folks are looking to loan sharks to try and get a loan.

A Loan shark will not be regulated by the authorities and also you ought to be very careful before deciding to explore this route.

Loan Sharks Alternatives

We have Lenders that are eager to lend to you personally no matter what your circumstances are.

Even for those who have poor or bad credit, unemployed and on benefits, we’ve got loan firms that still need to lend, so there is an alternate to loan sharks.

Should you submit an application for a loan using this website, the new Financial Conduct Authority regulations which are there to protect the people when taking out new loans Top Payday Loans will cover the process from start to finish.

Please be aware that a loan shark could charge you any interest rate he feels like and add any additional fees which he desires and we dread to think what extortionate fees will be used if you miss a payment with a loan shark!

Why not apply now to get your no obligation loan online with us today and have the money in your account today, totally without using any loan sharks.

Warning Signs of a Loan Shark

Loan sharks are notorious for extorting their victims. These individuals will offer you loans at outrageous interest rates, and have stern conditions regarding collection when you don’t pay back the money.

These individuals often operate outside the law and are not regulated by any regulatory body. These practices may be a threat to your financial stability, and can make you feel like you have no other choice. Here are some warning signs of a loan shark:

High interest rates

Predatory lending is a problem that has existed in the United Kingdom for many years. In many cases, these lenders came from mysterious sources and the media equated them with sharks.

Police crackdowns revealed that these lenders were part of an organized crime ring. Today, high interest rates for loan sharks are commonplace. However, there are differences between the two types of lenders.

A loan shark charges a high interest rate because the chances of not getting paid are higher. These loan sharks typically charge high interest rates because their business depends on people with poor credit and no way to get credit.

The interest rates for these loans are also higher than those charged by pawnshops, which have something to sell in case of non-payment. Ultimately, these lenders can damage a person’s credit score and financial situation.

Predatory practices

Loan sharks are unscrupulous individuals who charge extremely high interest rates and may even resort to violence if you can’t pay.

Often, these individuals can trap people who need only a small sum of money, causing them to end up owing thousands of pounds. Some of these individuals may even be involved in illegal activities.

While the majority of these individuals are legitimate, some may be a bit on the shady side.

Threatening tactics

Loan sharks use a variety of threats to extract money from unsuspecting victims. These predatory lenders avoid formal documentation and prefer to take payments via cash or bank transfers.

They do not tell victims about their loans or how much they charge, and sometimes take possessions as security for the loan. If a borrower does not repay the loan in time, the shark can threaten to lock up the flat or burn down the flat.

Other common tactics of loan sharks include sending flyers to neighbours and putting up expensive food deliveries. They may also use online chat rooms or social media to harass and intimidate their victims.

The authorities may need to use tools such as security cameras and bolt cutters to protect the public from the practice. These measures aren’t foolproof. But if you’re not willing to pay the money back, don’t take the loan.

Unrelenting collection practices

In a single year, a staggering one million people fall victim to the ruthless practices of loan sharks. In a desperate bid to make ends meet, families are forced to borrow cash from criminal lenders at extortionate rates – some as high as 130,000 per cent APR.

The victims are often intimidated into signing contracts that promise sexual favours in return for money. The Daily Express has joined a team of 14 police officers and investigators in raiding two properties in a market town. Police arrested a family man suspected of illegal lending at astronomical rates.

Loan sharks operate under the radar, sucking money from their clients. They enforce fees aggressively and often force debtors to take out another loan to pay off their debt.

Their collection practices are unrelenting and aggressive, forcing borrowers to keep borrowing money until they are unable to repay it. And if they are unable to collect their loans, they may resort to violence to evict their clients.

No guarantor

If you’re considering taking out a no guarantor loan, you’ll need to make sure you know what you’re getting into.

Loan sharks will take advantage of people with poor credit to gain access to money that they can’t afford. A guarantor is a person who agrees to pay off a loan if the borrower fails to make the repayments. However, this means that the loan may be expensive or don’t offer as much flexibility as you’d like.

The interest rates of no guarantor loans are usually much higher than those of their counterparts. Unless the borrower has excellent credit, no guarantor loans will usually carry a higher APR than a no guarantor loan.

Still, these loans are worth looking into, even if you have bad credit. A no guarantor loan is a great way to access cash fast.

No background check

If you’ve been the victim of a loan shark, you’re not alone. Illegal lending is rampant and the number of loan sharks has also risen.

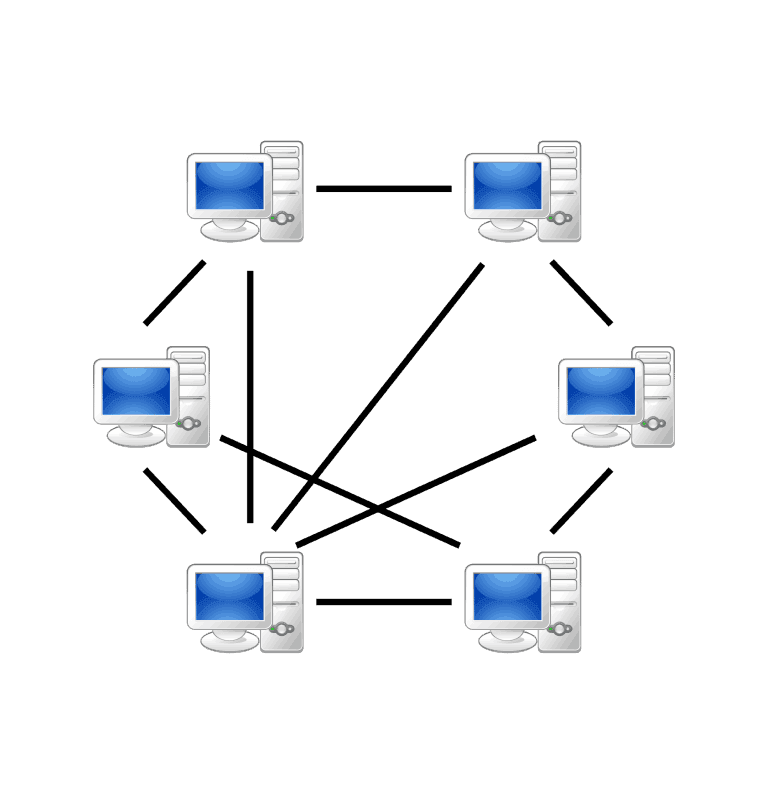

As a result of a shortage of employment opportunities, cyber loan sharks have emerged. These individuals use social media to threaten debtors.

While loan sharks do operate outside of government regulations, there are other, legitimate lenders. Payday lenders are state-regulated and follow a strict process to approve credit applications and sanction funds.

These loan sharks operate from underbanked neighborhoods. They may be found online or through personal connections.

Their main goal is to obtain large sums of money from unsuspecting customers, often at extremely high interest rates.

Loan sharks typically charge high interest rates and can enforce repayment terms by threats of violence. In addition to the danger of lending money to unsuspecting borrowers, loan sharks can be dangerous to you and your financial situation.