Guide to Capital Money Loans

Guide to Capital Money Loans – your credit cards are a kind of loan.

Once approved, most lenders will provide the availability of getting your money deposited electronically to your personal bank account in as quick as next working day.

Here Is A Guide to Capital Money Loans

What’s more, the business won’t let you pay off that cash advance until you’ve paid off the total balance for which you’re paying 20 percent interest.

Occasionally it’s to make the most of the opportunity a conventional lender doesn’t understand or lending regulations don’t permit.

Now you know how simple it is to have a small business loan, take a minute to complete and submit your organisation loan application.

Should you need cash today, this is actually the appropriate choice for you.

Usury is an alternative type of interest, where in fact the lender charges excessive interest.

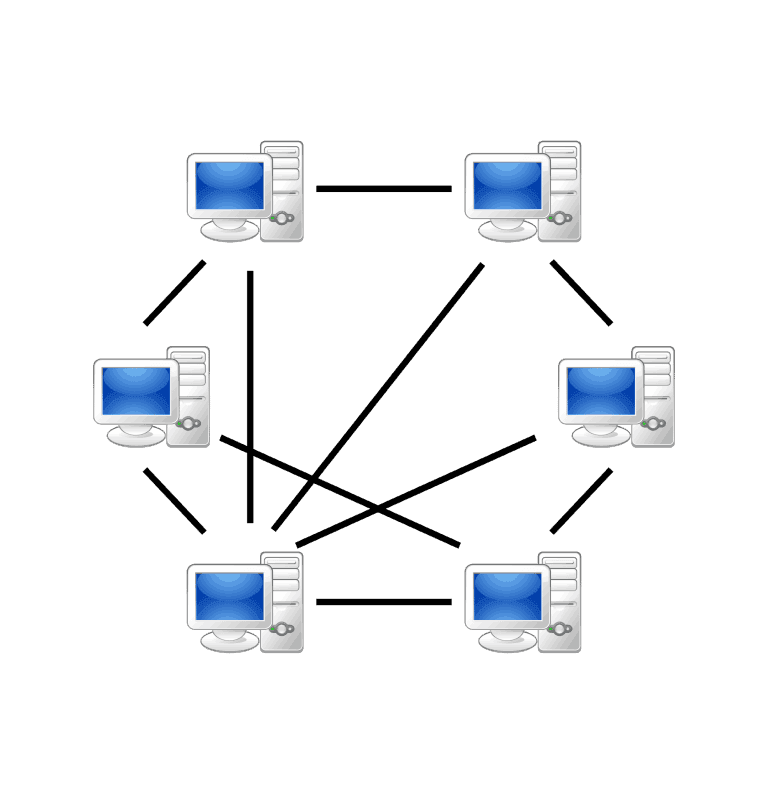

Peer-to-peer lenders will lend funds for many reasons to various types of people.

A fee is not charged unless you actually get an advance and you also only earn a payment if and when you get a recovery in your case.

The Fundamentals of Capital Money Loans Revealed

A mortgage loan is quite a common sort of loan, used by many people to buy things.

The financial loan is normally provided at a price, known as interest on the debt, which gives an incentive for the lender to engage within the financial loan.

Interest income can result from lenders even in the event the lender doesn’t charge a minimum quantity of interest.

Sometimes, a loan taken out to buy a new or second-hand car could be secured by the auto, in much the very same way for a mortgage is secured by housing.

Acting for a provider of loans is among the principal tasks for financial institutions including banks as well as charge card companies.

A previously submitted underwriting or appraisal fee will likely be returned just in the event a loan will not close on account of SECC error or failure to do as outlined within the LOI.

Short-term lenders could also rely on their own scoring criteria, which is usually predicated on income and capacity to repay, in addition to the obligor’s payment history of any former payday loans which have been made with the lending company in question, or with other payday lenders.

Generally, the quantity of savings really depends on the amount of your own debts, the present interest rates that you’re paying and any late fees or penalties you’ve got.

Click the links on this page to find out more about the Guide to Capital Money Loans.